Not known Details About Business Insurance Agent In Jefferson Ga

Things about Life Insurance Agent In Jefferson Ga

Table of ContentsFacts About Life Insurance Agent In Jefferson Ga RevealedWhat Does Auto Insurance Agent In Jefferson Ga Mean?The Best Strategy To Use For Auto Insurance Agent In Jefferson GaInsurance Agency In Jefferson Ga Fundamentals Explained

, the average annual expense for an auto insurance plan in the United States in 2016 was $935. Insurance coverage additionally aids you prevent the devaluation of your lorry.The insurance coverage safeguards you and aids you with cases that others make against you in crashes. It likewise covers legal prices. Some insurance provider offer a no-claim reward (NCB) in which qualified clients can receive every claim-free year. The NCB could be offered as a price cut on the costs, making car insurance policy much more budget friendly.

Several elements affect the costs: Age of the automobile: Oftentimes, an older car costs much less to insure contrasted to a newer one. Brand-new cars have a greater market value, so they set you back even more to repair or change. Components are much easier to locate for older lorries if fixings are needed. Make and model of vehicle: Some automobiles cost more to insure than others.

Specific lorries on a regular basis make the regularly taken listings, so you may have to pay a greater premium if you have one of these. When it comes to auto insurance policy, the 3 major kinds of policies are liability, collision, and detailed.

Insurance Agency In Jefferson Ga for Beginners

Some states call for motorists to bring this insurance coverage (https://www.quora.com/profile/Jon-Portillo-5). Underinsured motorist. Similar to without insurance protection, this policy covers problems or injuries you receive from a vehicle driver who doesn't carry sufficient protection. Motorcycle coverage: This is a policy especially for bikes because vehicle insurance coverage doesn't cover motorbike mishaps. The advantages of vehicle insurance coverage much outweigh the dangers as you could finish up paying countless dollars out-of-pocket for a crash you trigger.

It's typically far better to have more coverage than inadequate.

The Social Protection and Supplemental Safety Revenue special needs programs are the biggest of a number of Federal programs that give support to people with impairments (Insurance Agent in Jefferson GA). While these two programs are various in many ways, both are administered by the Social Security Administration and just individuals that have a disability and satisfy clinical standards may get benefits under either program

Utilize the Conveniences Qualification Testing Tool to discover which programs may have the ability to pay you benefits. If your application has just recently been refuted, the Internet Charm is a starting indicate ask for a review of our choice about your eligibility for handicap benefits. If your application is rejected for: Medical reasons, you can finish and send the Appeal Request and Charm Disability Report online. A subsequent evaluation of workers' settlement claims and the level to which absence, spirits and working with good workers were troubles at these companies shows the favorable impacts of using medical insurance. When compared to companies that did not provide medical insurance, it appears that offering FOCUS caused improvements in the capability to employ excellent employees, decreases in the variety of employees' payment insurance claims and reductions in the level to which absenteeism and productivity were problems for FOCUS organizations.

What Does Insurance Agent In Jefferson Ga Do?

Six records have actually been released, consisting of "Treatment Without Protection: Too Little, Too Late," which locates that working-age Americans without medical insurance are most likely to receive inadequate healthcare and obtain it as well late, be sicker and pass away earlier and get poorer treatment when they remain in the hospital, also for acute circumstances like an automobile collision.

The research study writers additionally keep in mind that increasing insurance coverage would likely result in a rise in genuine resource expense (regardless of that pays), since the without insurance receive concerning half as much treatment as the privately guaranteed. Health and wellness Affairs released the research study online: "Just How Much Healthcare Do the Uninsured Use, and Who Pays For It? - Business Insurance Agent in Jefferson GA."

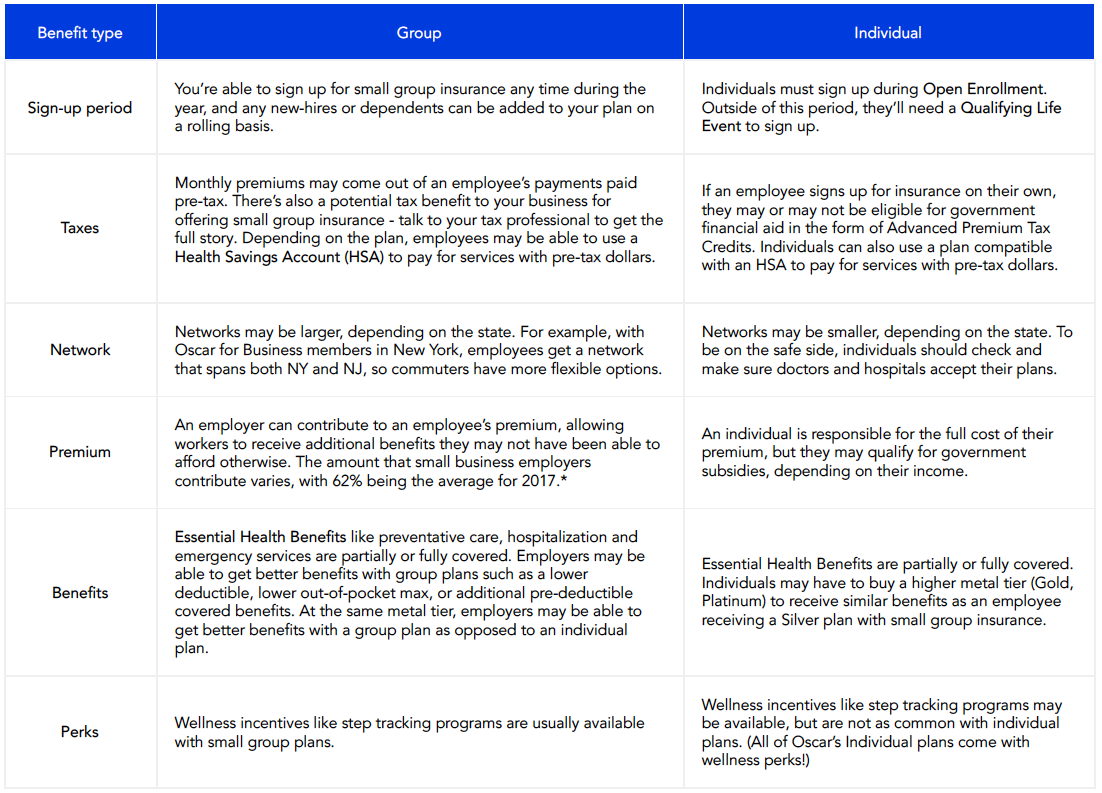

The responsibility of giving insurance coverage for workers can be a daunting and often pricey task and lots of local business assume they can't manage it. However are advantages for employees required? What advantages or insurance coverage do you legitimately require to give? What is the distinction in between "Employee Benefits" and "Worker Insurance policy"? Let's dive in.

The Ultimate Guide To Insurance Agency In Jefferson Ga

Employee benefits usually start with medical insurance and team term life insurance coverage. As part of the medical insurance plan, a company may opt to give both vision and dental insurance coverage. None of these are called for in many states, companies provide them to remain affordable. Most possible employees aren't going to help a business that doesn't give them accessibility to basic health care.

With the climbing fad in the expense of health and wellness insurance coverage, it is practical to ask staff members to pay a percentage of the coverage. Many services do put most of the cost on the staff member when they provide accessibility to wellness insurance coverage. A retirement (such as a 401k, SIMPLE plan, SEP) is usually used as a fringe benefit also - https://dribbble.com/jonfromalfa1/about.